Gratuity is a massive benefit payment made by the organization to the employees as a show of gratitude for services performed for the organization. It is critical to understand an employee’s entitlement and the sum of the bonus he or she will get.

Gratuity is the financial sum provided to a company’s staff under the Payment of Gratuity Act of 1972. The gratuity payment is one of the parts that build up the employee’s total compensation. However, an individual is only entitled to the gratuity if they have worked for the firm for 5 years or longer. It is typically a small sum offered by the employer to express thanks to the staff for their contributions to the organization.

Gratuity Payment Approach

The company can alternatively pay the gratuity sum out of their own pocket or arrange for a generic gratuities insurance program through a service provider. The firm subsequently makes annual payments to the service provider, and in exchange, the insurance company can pay the gratuity amount to the employee if the policy laws and regulations are followed. The company pays the entire bonus sum, with no payments from the employee.

Checklist for Gratuity Eligibility

Here is a list to see if an individual is qualified for a company gratuity:

- They must be entitled to superannuation.

- They quit following five years with the same employer.

- They retire from employment.

- They become disabled or die as a result of an accident or sickness.

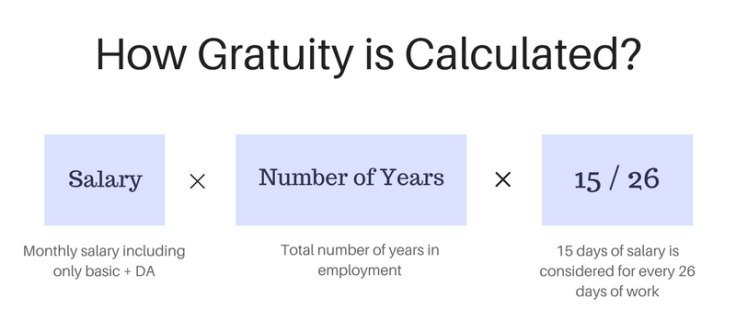

How to Calculate Gratuity on Salary?

Organizations compute the gratuity sum that shall be given to their employees using a simple math calculation. The gratuity formula is as follows:

Sum of Gratuity = Y x S x 15/26

Here Y is the number of years spent in the organization and S denotes the last pay earned, plus DA.

The company is permitted to give the staff a greater bonus, but the sum may not surpass Rs. 10 lakhs, per the Gratuity Act. Anything beyond INR 10 lakhs is described as ex-gratia, which is a voluntary payment that is not compelled by law.

To calculate the number of years of service for gratuity calculation, anything over 6 months is rounded off to the next number, and anything less than 6 months is rounded down to the previous number.

Also Read: Section 54 of the Income Tax Act

Also Read: Importance of Sustainable Development