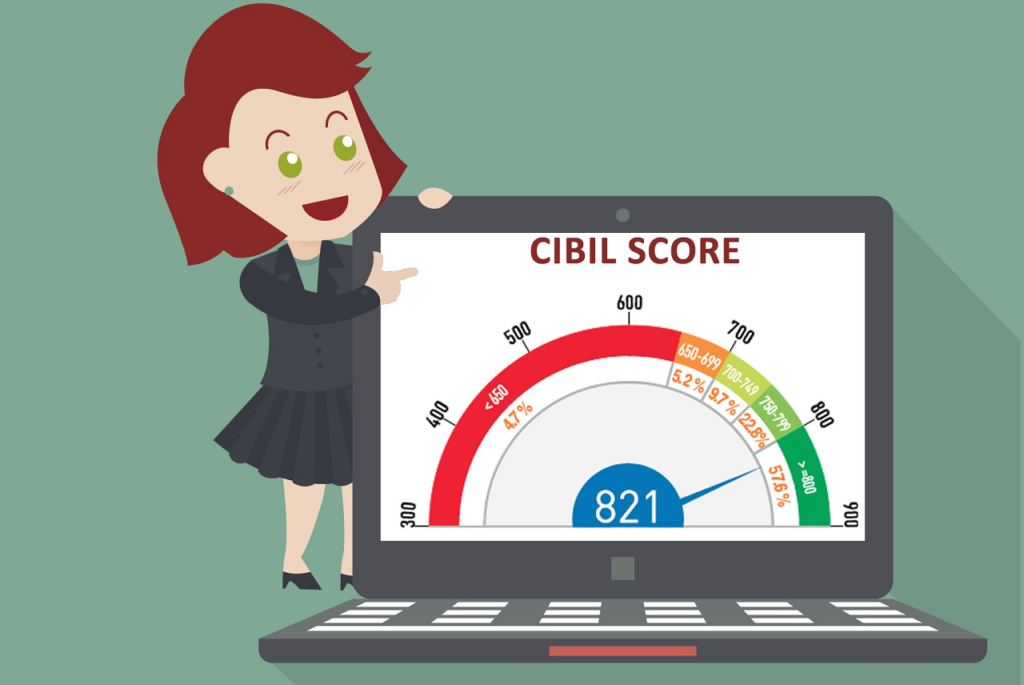

Trans Union CIBIL (Credit Information Bureau of India Limited), Experian, Equifax, and CRIF High Mark are the present four credit agencies that offer credit reports. CIBIL is the most well-known of these four agencies. A CIBIL score is a three-digit figure between 300 and 900. The nearer the score comes to 900, the stronger the solvency of the borrower.

Cibil Score Require for Home Loan

Once you seek a house loan, the bank looks at your credit rating to establish your ability to repay. It is typically regarded as excellent for getting approved if you have a baseline CIBIL Score of 750 or higher.

Avoid putting for many loans at the same time, as each application sent out to banks may have an impact on your credit score. A credit score holds all the information required by major banks to assess and also provide home loans.

CIBIL scores are heavily used in the execution of home loan requests. In reality, it is a primary factor used by banks to determine if approve or not to execute a house loan application. Once the submission is completed of the home loan application, the bank would first investigate the credit score and background. If your credit score is low and you have a poor credit history, your application will most likely be denied.

The home loan application will be handled faster if you have a strong CIBIL score. While there is no uniform score, each bank has a minimum CIBIL score that serves as a cut-off or signal when accepting or rejecting applications. Generally, a score of 750 or above is regarded as good, a score of 350-750 is regarded as just average or maybe unsatisfactory, and a rating of less than 350 is considered poor.

Improving Cibil Score

- Make absolutely sure you haven’t skipped your existing EMI or skipped card payments. You may prevent such errors by setting up fixed repayment alerts. Your CIBIL Score will undoubtedly rise if you make regular payments, portraying you as a dependable customer.

- You may sometimes ask your bank to extend the limits on your credit card, which will enable you to obtain the credit usage ratio low and ultimately enhance your credit score. You must also keep track of your credit consumption in order to use as little credit as feasible. Lower credit use over long stretches will demonstrate that you are able to handle additional credit, making it possible to obtain home loan clearance.

- To boost your CIBIL Score for a house loan, have a balanced credit mix, which includes getting the proper mix of protected and uninsured loans. Acquiring too many unsecured loans will harm your CIBIL Score.

- Keeping constant monitoring of your credit history is among the simplest methods to increase the CIBIL Score since it eliminates the possibility of any misleading data being included in the assessment pertaining to your repayments, EMIs, and more.

- You should not cancel the old accounts since the banks will learn your repayment capability and how well you have handled your credits previously and repaid them on time.

If you wish to get a home loan, your credit score is very important. A credit score is a number that represents your dependability. The credit score is calculated using your payment history. As a result, the lender has an easier time deciding to choose whether or not to approve a home loan.