Market capitalization

In stock market, the worth of a company is determined by the market itself. And this decides the worth of particular shares/ stock. The market value thus determined for a stock owned by the stockholder is known as market capitalization. The worth is calculated by the total outstanding shares of the company multiplied by its current market value, this is called Market Cap.

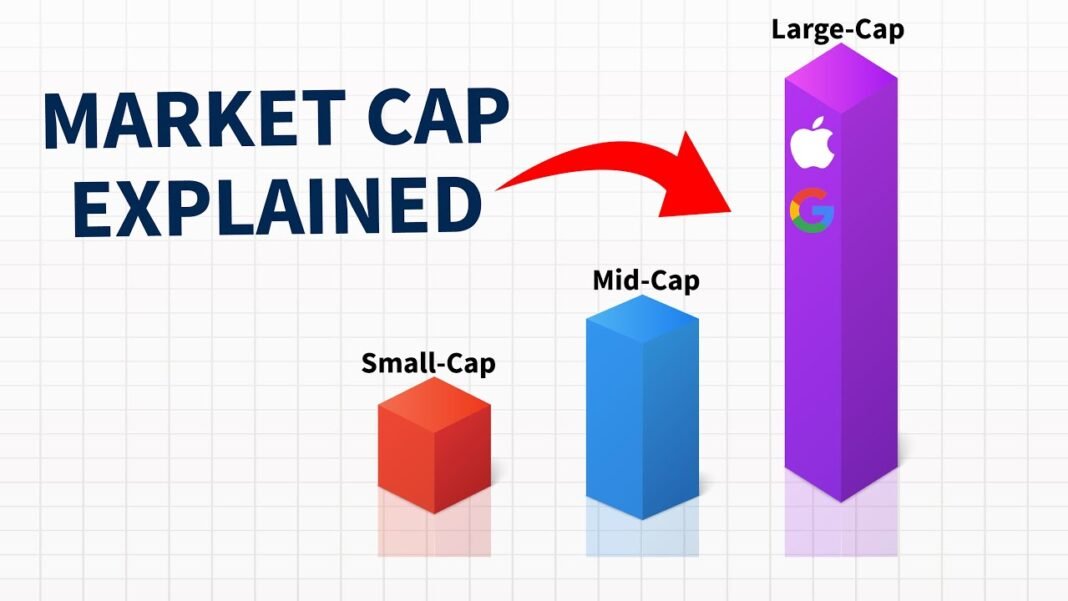

Market cap further defines three type of capitalization, Large – Cap, Mid – Cap, & Small – Cap. SEBI has issued guideline pertaining the classification of companies.

Large Cap

Large Cap Companies are the top 100 companies listed in the stock market. Known for their reliable return records, the market worth of these companies is significantly higher as compared to others. The market valuation of these Large Cap companies is Rs. 20000 Cr. or higher.

It is best suited for safe investors who are in for a stable return. When it comes to growth, large cap companies provide more stability than growth and already have good reputation.

Known for their lesser volatility, the stocks of large cap companies provide stability to a portfolio and guarantee better liquidity and returns. Talking about the return, the returns are more stable yet they only provide average returns as compared to mid-cap or small cap company stocks.

Mid Cap

Companies ranking ranging from 101 to 250 top companies fall in the Mid Cap company range. The valuation for this range is usually between Rs. 5000 Cr. to 20000 Cr. Naturally there is a bit more risk involved with the performance of these companies and which has limited market presence, as compared to Large Cap companies.

As mid cap company, performance of the stocks still have the prospect of further progress and hence can account for potential for growth as compared to a large cap company.

Suitable for investors who can tolerate moderate risk associated with these stocks, usually invested on for diversifying the portfolio. They are moderately volatile and hence offer moderate liquidity. When compared to a large cap company the mid cap company may give a shareholder better return.

Small Cap

Companies whose market valuation fall below Rs. 5000 Cr. and ranked above 251st position are defined as small cap companies. Usually, the companies that do not have a long history fall under this range. Investors who intend gain higher returns with an aggressive strategy usually invest in small cap companies.

Investing in a small cap company requires extensive research about the company. As a small cap company, the companies have lot more untapped potential and this offer more growth prospects, making them a favourite among aggressive investors.

Their market presence is nearly negligible and there is much risk involved in the trade of their stocks. Given the ranges nature the stocks for small cap companies act more volatile and have less liquidity. Because of its volatile nature though, small cap companies may give very good returns as compared to both large cap and mid cap companies.