Portfolio management is the process of making decisions about investment mix and policy, matching investments to objectives, asset allocation for individuals and institutions, and balancing risk against performance. In other words, it’s a way to ensure that you’re achieving your financial goals in the most efficient way possible.

There are a few key things that portfolio managers do: they assesses the risk and return of each investment in a portfolio, they monitor investments to make sure they’re performing as expected, and they rebalance the portfolio when necessary.

Portfolio management is a critical process for anyone with investments, whether you’re managing a retirement fund or a college savings account. Keep reading to learn more about how portfolio management works and why it’s so important.

What is portfolio management?

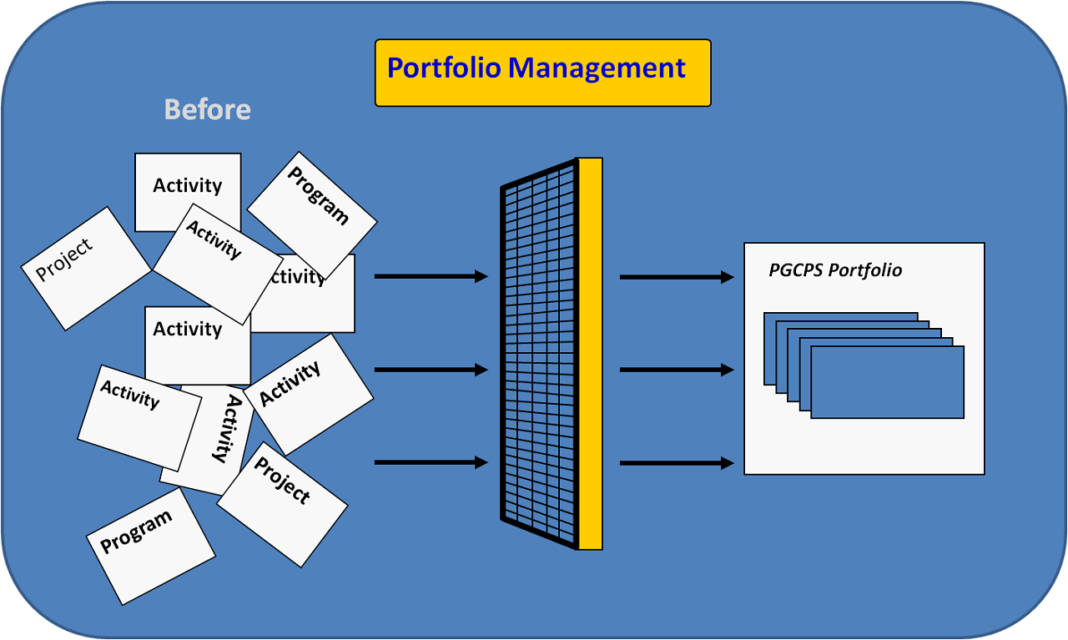

Portfolio management is the process of aligning an organization’s goals and objectives with its available resources. In other words, it ensures that an organization’s investment in people, processes, and technology are best aligned to achieve its desired outcomes.

Portfolio management includes four key steps:

1. Defining the organizational strategy

2. Assessing the current portfolio

3. Prioritizing projects

4. Managing and executing projects

When done correctly, portfolio management can help organizations achieve their goals by ensuring that resources are best allocated to high-priority initiatives. Additionally, it can help reduce risks by identifying and addressing potential problems early on.

The different types of portfolio management

There are many different types of portfolio management, each with its own strengths and weaknesses. The most common type of portfolio management is buy-and-hold investing, which involves buying stocks or other assets and holding them for a long period of time. This strategy can be successful if the underlying asset appreciates in value over time, but it can also lead to large losses if the asset devalues.

Another common type of portfolio management is active investing, which involves frequently buying and selling assets in an attempt to make profits. This strategy can be more risky than buy-and-hold investing, but it can also lead to higher returns if done correctly. Active investing often requires more knowledge and experience than buy-and-hold investing, so it may not be suitable for all investors.

Finally, there is also index investing, which involves buying a basket of assets that track a specific market index. Index funds are often seen as a safe investment because they provide diversification and are typically less volatile than individual stocks. However, index funds generally have lower returns than actively managed portfolios.

The benefits of portfolio management

Portfolio management is the process of identifying, prioritizing, and managing projects within an organization. By understanding the benefits of portfolio management, organizations can make more informed decisions about which projects to pursue and how to allocate resources.

The benefits of portfolio management include:

1. Increased alignment between organizational goals and project selection

2. Better utilization of resources

3. Improved project prioritization

4. Greater visibility into the status of projects

5. Reduced risk

The risks of portfolio management

When it comes to portfolio management, there are a number of risks that need to be considered. These include:

1. Market Risk: This is the risk that the value of your investments will go down due to factors such as economic recession or market volatility.

2. Interest Rate Risk: This is the risk that interest rates will rise and fall, which can impact the value of your investments.

3. Inflation Risk: This is the risk that inflation will eat into the value of your investments over time.

4. Liquidity Risk: This is the risk that you will not be able to sell your investments quickly enough if you need to raise cash in a hurry.

5. Credit Risk: This is the risk that a company or country will default on its debt obligations, which could impact the value of your investments.

How to create a portfolio management plan

A portfolio management plan is a tool that helps investors to make decisions about how to allocate their investment resources. The portfolio management plan guides the investor in creating a diversified investment mix that meets their financial goals and objectives.

The first step in creating a portfolio management plan is to define the investor’s goals and objectives. The investor’s goals will determine the type of investments that are appropriate for the portfolio. For example, an investor who is saving for retirement will have different investment goals than an investor who is trying to generate income from their investments.

Once the investor’s goals have been defined, the next step is to create an asset allocation strategy. This asset allocation strategy will determine what percentage of the portfolio should be invested in each asset class. The most common asset classes are stocks, bonds, and cash.

After the asset allocation has been determined, the next step is to select the specific investments that will be included in the portfolio. When selecting investments, it is important to consider factors such as risk, return, and liquidity.

Once the investments have been selected, the final step is to monitor and rebalance the portfolio on a regular basis. This will ensure that the portfolio remains diversified and aligned with the investor’s goals and objectives.

Also Read: Difference Between Demat and Trading Account