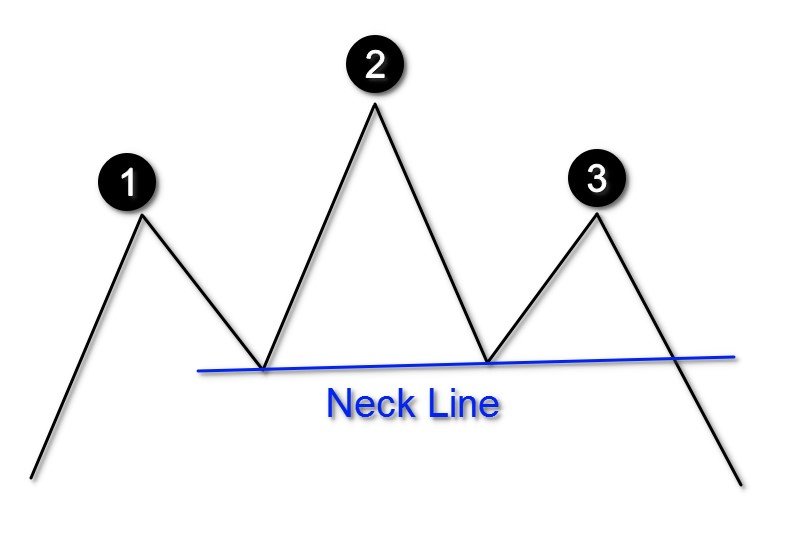

The head and shoulders pattern is one of the most reliable and well-known reversal patterns in technical analysis. The basic idea behind this pattern is that after a prolonged uptrend, the market will form a top, represented by the left shoulder, head, and right shoulder. Once the right shoulder forms, it signals that the buyers are losing steam and that the market is ripe for a reversal.

There are many variations of this pattern, but the most important thing to remember is that the left shoulder should be lower than the head, and the right shoulder should be lower than the left shoulder. The neckline is also important; it should be drawn as a horizontal line connecting the lows of the two shoulders. Once you’ve identified a head and shoulders pattern, you can use it to your advantage by entering a short position when the neckline is broken.

What is the Head and Shoulders Pattern?

The head and shoulders pattern is a graphical representation of price movements in the market. It is characterized by three peaks, with the middle peak being the highest and the two side peaks being lower. The pattern is considered to be a bearish reversal signal, as it indicates that the market has reached a top and is likely to move lower.

How to Identify the Head and Shoulders Pattern

The head and shoulders pattern is a technical analysis charting pattern that is used to predict reversals in the market. The pattern is created when the price of an asset forms two peaks, with the second peak being lower than the first, and a trough in between.

To identify the head and shoulders pattern, look for the following:

- Two distinct peaks: The first peak should be followed by a decline, and the second peak should be lower than the first.

- A trough in between: This is what gives the head and shoulders their characteristic “M” shape.

If you see this pattern forming on a chart, it’s a good indication that the current trend is about to reverse.

How to Trade the Head and Shoulders Pattern

The head and shoulders pattern is a classic technical analysis signal that indicates a potential reversal in the market. This pattern is created when the price action forms a peak (head), followed by a higher peak (right shoulder), and then finally a lower peak (left shoulder). The neckline of the pattern is created by connecting the lows of the two shoulders.

When the head and shoulders pattern is complete, traders will often watch for a breakout below the neckline to signal that the reversal is complete and enter into short positions. Conversely, some traders may choose to wait for a candlestick patterns to form at support before entering into long positions.

There are many different ways to trade the head and shoulders pattern, so it’s important to do your own research and develop a strategy that fits your trading style.

Advantages and Disadvantages of the Head and Shoulders Pattern

There are a few key things to remember when it comes to the head and shoulders pattern. First, this pattern generally forms after an extended uptrend. Second, the left shoulder typically forms at a slightly lower high than the head, and the right shoulder typically forms at a lower high still.

The advantage of this pattern is that it can provide traders with a clear entry and exit point. The disadvantage is that false breakouts are relatively common, so it’s important to use other technical indicators to confirm the breakout before taking a position.

Also Read: What Is Fundamental Analysis