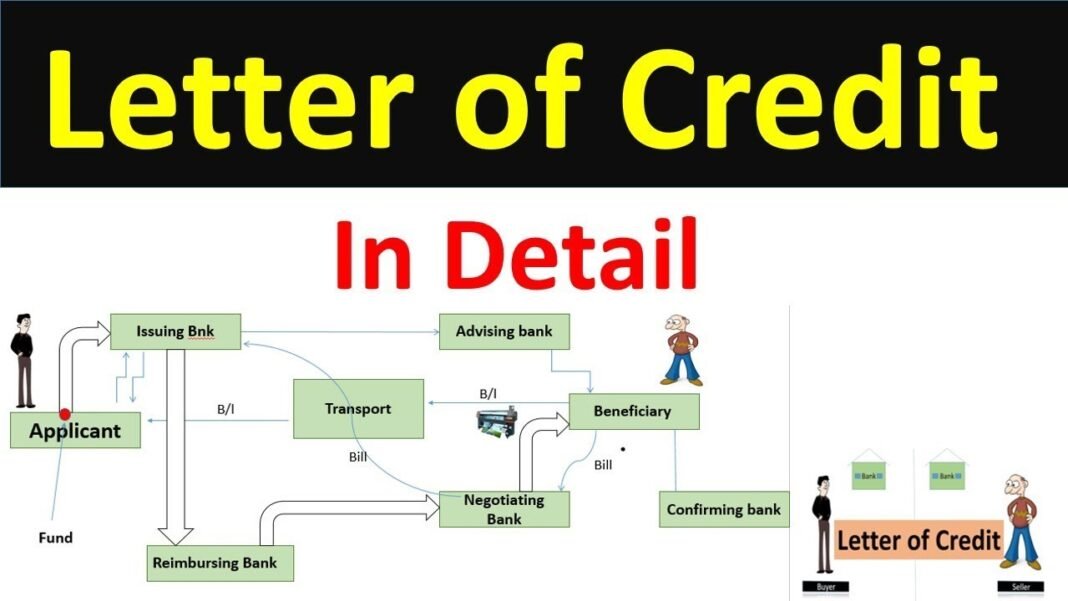

A letter of credit is a document that a bank issues to guarantee payment for a transaction. The letters of credit gives the recipient (the “beneficiary”) of the letter a guarantee that they will receive payment as long as they meet the terms specified in the letter. The terms of the letters of credit are negotiated between the issuer (the “applicant”), the beneficiary, and the bank.

The negotiation process is important because it sets out the rights and obligations of each party in the event that something goes wrong with the transaction. Once the terms are agreed upon, the issuer pays the bank a fee for issuing the letters of credit. The fee is usually a percentage of the value of the transaction.

What is a letter of credit?

A letter of credit is a document that guarantees payment from a buyer to a seller. The buyer’s bank issues the letters of credit and guarantees that the funds will be available to the seller on the agreed upon date. This type of payment method is often used in international trade transactions where there is a risk that the buyer may not be able to make payment.

The different types of letters of credit

A letters of credit is a document that guarantees payment from a buyer to a seller. There are different types of letters of credit, each with its own set of rules and regulations. The most common types of letters of credit are:

1. Commercial Letter of Credit

A commercial letters of credit is the most common type of letters of credit. It is typically used in international trade transactions to guarantee payment from a buyer to a seller. The commercial letter of credit must be issued by a bank that is acceptable to both the buyer and the seller.

2. Standby Letters of Credit

A standby letters of credit is a type of letters of credit that guarantees payment if the party who owes the money fails to pay. Standby letters of credit are often used in construction contracts or other situations where one party needs to have assurance that they will be paid even if the other party does not fulfill their obligations.

3. Transferable Letters of Credit

A transferable letters of credit is a type of letters of credit that allows the beneficiary (the party being paid) to transfer the letter of credit to another party. This issue full when multiple parties are involved in the purchase of goods or services, and one party needs assurance that they will be paid even if the other parties do not follow through on their obligations.

How to use a letter of credit

When a buyer and seller enter into a contract, the buyer may request the use of a letters of credit to guarantee payment. The letters of credit is issued by the buyer’s bank and guarantees that the funds will be available to pay the seller. If the buyer does not have the funds available when payment is due, the bank will pay the seller from the letters of credit.

To use a letters of credit, the buyer must first provide their bank with a copy of the contract and request that a letters of credit be issued. The bank will then send a letter of credit to the seller’s bank. The seller’s bank will confirm that the letters of credit has been received and that it is valid. Once payment is due, the seller will submit an invoice to their bank which will in turn present it to the buyer’s bank for payment. If all goes smoothly, payment will be made and everyone involved will be paid according to the terms of the contract.

There are some risks associated with using a letters of credit. If something goes wrong with any part of the process, it can delays payments or result in non-payment. It is important to make sure that all banks involved are reputable and that all documents are in order before proceeding with this type of transaction.

Advantages and disadvantages of using a letter of credit

There are a few advantages and disadvantages to using a letters of credit. The main advantage is that it offers protection for the buyer in the event that the seller does not deliver on their promise. In this case, the buyer can request that the issuing bank reimburse them for any losses incurred.

Another advantage is that letters of credit are often seen as more reliable than other forms of payment, such as personal checks or wire transfers. This can be helpful when dealing with international transactions, where there may be more concern about the reliability of the other party.

However, there are also a few disadvantages to using a letters of credit. One is that they can be costly, since banks typically charge fees for issuing and administering them. Additionally, they can be complex to set up and manage, which can create frustration and delays if not done correctly.

Finally, if the underlying transaction falls through or is not completed as expected, it can be difficult to cancel or change a letters of credit since it is a binding agreement between the parties involved.

When to use a letter of credit

A letter of credit is a type of payment guarantee that is often used in international trade. If you are an importer, a letters of credit can give you some security that your exporter will get paid. If you are an exporter, a letters of credit can give you some assurance that you will get paid for your products or services. In either case, a letters of credit involves three parties: the importer, the exporter, and the bank.

Also Read: Section 192 of Income Tax Act