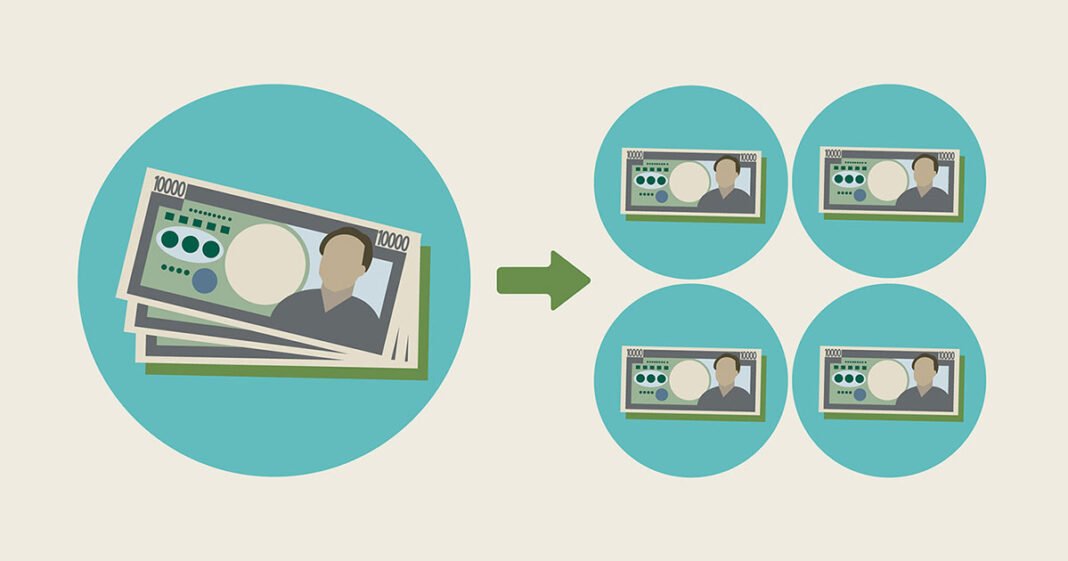

A stock split is a corporate action in which a company divides its existing shares into multiple new shares to boost liquidity and encourage more investors to trade. The most common type of stock split is a 2-for-1 split, meaning that for each share an investor owns, they will receive two new shares. A 2-for-1 split would result in the number of outstanding shares doubling, but the value of each individual share would be halved.

While stock splits are typically seen as a bullish sign by the market, there is no guarantee that a stock price will increase after a split. In fact, sometimes prices may even drop in the short-term as investors digest the news. In this article, we will take a closer look at stock splits: how they work, what impact they can have on a company’s share price, and some of the most famous splits in history.

What is a stock split?

A stock split is a corporate action in which a company divides its existing shares into multiple new shares to boost the liquidity of the stock. A stock split does not change the value of a shareholder’s investment, but it does increase the number of shares that they own.

This can be beneficial for shareholders because it makes it easier to trade their shares, and also allows them to invest smaller amounts of money while still owning a portion of the company. For example, if a company with 100 shares worth $10 each splits its stock 2-for-1, shareholders will end up with 200 shares that are each worth $5.

Stock splits are usually done on a ratio basis, such as 2-for-1 or 3-for-2. However, companies sometimes do odd splits, such as 3-for-1 or 5-for-4.

The main reason why companies split their stock is to make it more affordable for small investors and to increase liquidity. Liquidity is the degree to which an asset can be bought or sold without affecting its price. When a company’s stock is trading at high prices, it can be difficult for small investors to buy shares; by splitting the stock, companies make it easier for these investors to get involved.

How does a stock split work?

A stock split is a corporate action in which a company divides its existing shares into multiple new shares to boost liquidity and shareholder value. A stock split does not change the value of a company, but it does increase the number of shares outstanding, and therefore can have an impact on share price.

There are two types of stock splits:

1. A regular stock split, also known as an ordinary or conventional stock split, sees a company’s share price divided into a larger number of shares. For example, if a company with 100 shares priced at $10 each were to do a 2-for-1 stock split, shareholders would end up with 200 shares priced at $5 each.

2. A reverse stock split sees the number of shares reduced while the share price increases proportionately. So, continuing with our example from above, if that same company did a 1-for-2 reverse stock split, shareholders would own 50 shares worth $20 each after the split.

Stock splits are generally undertaken when a company’s share price has become too high for investors to buy or sell easily – meaning there is low liquidity in the market for that particular stock. By dividing the shares into smaller units, it becomes easier and more affordable for investors to trade them. This increased liquidity can lead to higher demand and, as a result, an uptick in the share price.

What are the benefits of a stock split?

A stock split is a corporate action in which a company divides its existing shares into multiple new shares to boost the liquidity of the stock. A stock split can also be used to try to increase the share price by making it more affordable for investors and thus increasing demand. Stock splits are usually done on a 2-for-1 or 3-for-2 basis, meaning that for every old share you own, you receive two or three new shares, respectively.

There are several benefits that can come from a stock split. For starters, it can make the shares more affordable and thus increase demand. This can lead to an increase in the stock price, which is beneficial for shareholders. Additionally, a stock split can also lead to an increase in liquidity as there are now more shares available for trading.

This can make it easier for investors to buy and sell shares, which can again lead to an increase in the stock price. Finally, a stock split can also signal to the market that the company is doing well and is confident about its future prospects. This positive perception can help attract new investors and further boost the stock price.

Also Read: Black Swan in the Stock Market